🇺🇲 watson :dealwithit: · @watson

501 followers · 40637 posts · Server freeatlantis.comBiden’s 3rd world makeover of America is finally complete:

✅ Funding govt w/ printing press

✅ Runaway inflation

✅ Prosecuting rivals w/ fake crimes

✅ Giving friends state contracts

✅ Turning state security apparatus against citizens

✅ Bribing voters

https://video.twimg.com/amplify_video/1562212670614675456/vid/480x270/HBigXJYi7GoNxmbY.mp4

https://twitter.com/thehill/status/1562213343519293440

https://twitter.com/tomselliott/status/1562217598808473600

#StudentLoan

#StudentLoanForgiveness

#StudentLoanCancellation

#StudentLoan #Studentloanforgiveness #studentloancancellation

🇺🇲 watson :dealwithit: · @watson

492 followers · 40087 posts · Server freeatlantis.comFJB: Today, I'm proud to announce a new student debt repayment program called the SAVE Plan.

It's the most affordable student loan plan ever. And a promise kept in fixing the existing student loan program.

Let me explain how it works:

https://twitter.com/POTUS/status/1693962658775474442

https://video.twimg.com/amplify_video/1693962475538976768/vid/320x568/0AeNV7vDw8_b39Mh.mp4

#Studentloanforgiveness #studentdebtrepaymentprogram

🇺🇲 watson :dealwithit: · @watson

491 followers · 38041 posts · Server freeatlantis.com

🇺🇲 watson :dealwithit: · @watson

488 followers · 37605 posts · Server freeatlantis.com#StudentLoanForgiveness who wants to be the one to tell him this was an executive order, not an act of Congress?

https://twitter.com/RNCResearch/status/1674887637935570944

🇺🇲 watson :dealwithit: · @watson

487 followers · 37594 posts · Server freeatlantis.com🚨 Supreme Court strikes down biden’s #StudentLoanForgiveness plan:

“The Supreme Court on Friday invalidated President Joe Biden’s student loan debt relief plan, meaning the long-delayed proposal intended to implement a campaign trail promise will not go into effect.

The justices, divided 6-3, ruled that the program was an unlawful exercise of presidential power because it had not been explicitly approved by Congress.”

CultureStorm · @rootwoman123

36 followers · 185 posts · Server mastodon.worldHey Young People. You're up! #GenZ #VoteBlue #SaveTikTok #ClimateAction #StudentLoanForgiveness #LGBTQ #BlackLivesMatter #GunControlNow

#GenZ #voteblue #savetiktok #climateaction #Studentloanforgiveness #lgbtq #blacklivesmatter #guncontrolnow

MJ Muse · @MJmusicinears

340 followers · 3539 posts · Server mastodon.worldhttps://www.politico.com/news/2023/02/28/5-moments-supreme-court-student-debt-00084882 5 key moments from the Supreme Court showdown over Biden’s student debt relief

Here’s POLITICO’s look at five key aspects of the closely watched arguments on one of the Biden administration’s highest-profile policy initiatives

#IllegitimateSCOTUS #Studentloanforgiveness

They Call Me Dr. Breaux · @doctorjaymarie

863 followers · 2474 posts · Server mastodon.world#BlackMastodon #BlackFedi #StudentLoanForgiveness

Something tells me that this court will reject President Biden's loan forgiveness program.

Supreme Court seems ready to reject student loan forgiveness

https://apnews.com/article/student-loan-forgiveness-supreme-court-hearing-2128da75fc27ff3bcc0c3804ebd98aa7

#blackmastodon #BlackFedi #Studentloanforgiveness

MoiraEve · @MoiraEve

323 followers · 1898 posts · Server mastodon.worldSix Republican-led states (Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina) are suing to overturn President Biden’s #StudentLoanForgiveness plan.They want to invalidate Biden’s policy b/c their own state loan services might see a drop in revenue.

They Call Me Dr. Breaux · @doctorjaymarie

861 followers · 2505 posts · Server mastodon.world#BlackMastodon #BlackFedi #StudentLoanForgiveness

Student loan forgiveness Supreme Court hearing, explained

https://apnews.com/article/student-loan-forgiveness-supreme-court-case-explained-8c62622e87c4ebff995f971263d932fc

#blackmastodon #BlackFedi #Studentloanforgiveness

MJ Muse · @MJmusicinears

338 followers · 3516 posts · Server mastodon.worldBiden’s student loan forgiveness program comes before the illegitimate partisan Supreme Court tuesday

https://www.washingtonpost.com/education/2023/02/26/biden-student-debt-supreme-court/ #BidenAgenda #StudentLoanForgiveness #ExtremistSCOTUS #IllegitimateSCOTUS

#Bidenagenda #Studentloanforgiveness #extremistscotus #IllegitimateSCOTUS

MJ Muse · @MJmusicinears

310 followers · 3357 posts · Server mastodon.worldhttps://crooksandliars.com/2023/02/students-swarm-dc-scotus-considers-biden #StudentLoanForgiveness Supporters of President Joe Biden's stalled student debt relief proposal are

planning to rally outside the #IllegitimateSCOTUS in Washington, D.C. at the end of the month as justices hear a case from #GOPtraitorsToDemocracy challenging the administration's long-awaited program

#Studentloanforgiveness #IllegitimateSCOTUS #GOPTraitorsToDemocracy

Dave · @Drawza

20 followers · 39 posts · Server mastodon.lolBoycott Home Depot Calls After Founder Helped Block Student Debt Relief. #HomeDepot #boycott #StudentLoans #StudentLoanForgiveness

https://www.newsweek.com/boycott-home-depot-calls-after-founder-helped-block-student-debt-relief-1762301

#HomeDepot #boycott #studentloans #Studentloanforgiveness

Pucci Dee · @adpucci

17 followers · 859 posts · Server mastodon.worldRT @NirviShah@twitter.com

#Studentloanforgiveness tied up in court so @POTUS@twitter.com is extending the pause on payments through June 2023 https://www.usatoday.com/story/news/2022/11/22/broad-student-loan-forgiveness-doubt-biden-extends-payment-pause/10758171002/ via @CQuintanaDC@twitter.com @joeygarrison@twitter.com

🐦🔗: https://twitter.com/NirviShah/status/1595152069584822272

Going Brogue (she/her) 🇺🇸🇺🇦 🌊 · @GoingBrogue

131 followers · 493 posts · Server mastodon.worldDue to lawsuits against Biden's student loan forgiveness plan, the administration is extending the student loan repayment pause. Sounds like it could be until June (and possibly later.) It will depend on how the challenges to debt forgiveness play out.

#USPol #USPolitics #StudentLoanRepayments #StudentLoanForgiveness #StudentLoanRepaymentPause

#breakingnews #uspol #uspolitics #studentloanrepayments #Studentloanforgiveness #studentloanrepaymentpause

swtyndall.notwhatwethink · @notwhatwethink

149 followers · 918 posts · Server climatejustice.socialPart 3

Like parasites complaining because they are about to be de-wormed!!

The little-known student loan middlemen who are threatening debt forgiveness - MarketWatch https://www.marketwatch.com/story/the-little-known-student-loan-middlemen-who-are-threatening-debt-forgiveness-11668786732?reflink=mw_share_twitter

#GreedIsAnti-Social

#StudentLoanForgiveness

"Borrowers face long wait times

Now, that servicing income is part of what’s at issue in the six state lawsuit challenging the broad-based student debt forgiveness. The states have argued that canceling debt would hurt MOHELA’s bottom line — and therefore Missouri’s — because it would eliminate many of the accounts serviced by MOHELA.

At the same time, state attorneys general are invoking the potential for MOHELA, which works with borrowers across the country, to lose student-loan accounts in litigation challenging the debt-relief program, borrowers and advocates are criticizing the way the organization has handled a recent major increase in account volume.

...

Meanwhile, while borrowers like Morton were struggling to reach MOHELA, the organization’s interests are being invoked in the lawsuit brought by the six states. And though the 8th circuit’s ruling was in part based on the idea that potential harm to MOHELA is enough for Missouri to have standing to sue, the organization told Bush, the Missouri Congresswoman, in the letter that its executives “were not involved with the decision of the Missouri Attorney General’s Office,” to file the lawsuit aimed at blocking the debt relief plan.

The only communication the organization has had with the Missouri Attorney General’s office related to the student debt relief plan is through open records requests filed by the attorney general’s office for MOHELA documents related to its loan servicing contract, the organization wrote.

SBPC and the American Federation of Teachers wrote to MOHELA in October asking the organization to withdraw from the suit. In the letter they warned that participating in the suit puts the MOHELA at risk of violating a California law regulating student loan servicers in that state.That’s because the law bans these organizations from “substantially interfering” with state residents’ right to loan forgiveness.

SBPC and AFT are willing to sue MOHELA over that alleged violation in order to enforce the California law. The letter they sent served as a notice they were required to give MOHELA at least 45 days before taking any action. The organization hasn’t responded, according to SBPC, and if they don’t before the deadline, SBPC and AFT have the right to sue.

With the government no longer making loans under the bank-based program, the portfolio of old loans originally owned or guaranteed by these state-related entities continues to shrink and “there’s still no plan to deal” with these organizations, Bergeron said. “Then they can make mischief or people can make mischief on their behalf.”

He points to another example besides the student-debt relief lawsuit. In Rhode Island, where Bergeron lives, one of these state-affiliated organizations advertised its refinance product after the Biden administration announced its debt-relief plan. That’s even though any borrowers who refinanced their federal student loans into private debt would be ineligible for the debt relief.

...

Pastorious called the appearance of the ad Bergeron saw “frustrating, since we always try to do the best thing for borrowers.”

“Borrowers have had to provide, in writing, a statement that they understand they are giving up federal loan benefits, including potential loan forgiveness, if they wish to include a federal loan in a RISLA refinance loan,” he said in the email. “There are also several disclosures and links throughout our application process and website to help educate and inform borrowers about federal loan benefits and loan forgiveness.”

Still, Bergeron finds the ad troubling.

“They’re basically encouraging them to give up on the $10,000 or $20,000 in cancellation they might be entitled to,” he said. “I find it inexcusable for any government entity.”""

#greedisanti #Studentloanforgiveness

swtyndall.notwhatwethink · @notwhatwethink

149 followers · 917 posts · Server climatejustice.socialPart 2

Like parasites complaining because they are about to be de-wormed!!

The little-known student loan middlemen who are threatening debt forgiveness - MarketWatch https://www.marketwatch.com/story/the-little-known-student-loan-middlemen-who-are-threatening-debt-forgiveness-11668786732?reflink=mw_share_twitter

#GreedIsAnti-Social

#StudentLoanForgiveness

"MOHELA in 2006 claimed that $226 million of loans were eligible for the 9.5% subsidy instead of $43 million that actually qualified, according to an analysis of government records by Oberg, who worked on student aid policy at the state and federal level for decades. MOHELA vowed to stop, but the organization, like other state-affiliated entities accused of the same practice, didn’t return the ill-gotten funds because the Department of Education didn’t require it.

Though founded as entities with a mission of increasing access to higher education for their state’s students, the 9.5% subsidy scandal was just one example of the ways in which critics say these state-affiliated organizations and their leadership have sought to maximize the money they make off the federal student-loan program in a manner similar to private sector firms.

Blurring the lines

In the late 1990s, some of these organizations even began to convert to for-profit companies — and consumer advocates watched with alarm as the line between for-profit and tax exempt state agencies began to blur. By law, if they wanted to convert, these organizations had to preserve the nonprofit’s assets for the public good. In 1998, Nebraska’s state-affiliated secondary market, NebHelp, converted to a for-profit company called Nelnet, which still services student loans today, and launched a nonprofit called the Foundation for Education Funding to comply with the legal requirements, according to a 2000 report from Consumers Union, the publisher of Consumer Reports.

That organization created a scholarship program for low-income students, but in order to be eligible to receive the funds, the students had to use the type of federal student loan offered by Nelnet, the report noted. This requirement effectively shut out students interested in attending the University of Nebraska-Lincoln, the largest college in the state, which used another type of federal student loan.

The Foundation for Educational Funding also used about $800,000 to launch centers in the state that provided students with information about colleges, scholarships and financial aid. Only the for-profit company affiliated with the nonprofit was allowed to advertise in those centers, according to Consumers Union.

The goal of the benefits the federal government provided these state-related entities over the first several decades of the student loan program — like assuming almost all of the risk for guaranty agencies and offering secondary market operators special subsidies — was to encourage them to participate in the program and ensure that enough capital was available for students to continue to borrow to attend college.

But during the financial crisis, investors became skittish about providing capital to private lenders in the student-loan system, despite the federal guarantee. To ensure students would be able to access loans to pay for college, the government essentially bailed these and other entities that owned federal student loans out — the feds bought up some of some of the loans held by private lenders so they’d have the capital to make new ones.

“At that moment when students needed the money the most — their parents couldn’t get home equity loans — the system froze,” Bergeron said. “That, for me, was the biggest failure,” of the bank-based student loan system, he added.

When, about a year later, the Obama administration sought to end the bank-based student-loan system and have new federal student loans be made exclusively by the government directly to students, state-affiliated as well as nonprofit guaranty agencies and secondary market operators fought the transition, lobbying their members of Congress to keep the bank-based loan system in place.

When that didn’t work, “they demanded a piece of the contracts that came afterwards,” Shireman said. During that period, when he served as Deputy Undersecretary of Education, Shireman visited MOHELA’s headquarters near St. Louis, where leadership and state lawmakers were concerned about how the transition to direct lending would impact jobs in the state.

Though there would be no new bank-based loans for these organizations to originate or guarantee they received a vow from Congress that at least some would be able to participate in the direct lending program as servicers, or the organizations that manage student loan payments on behalf of the federal government.

#greedisanti #Studentloanforgiveness

swtyndall.notwhatwethink · @notwhatwethink

149 followers · 916 posts · Server climatejustice.socialLike parasites complaining because they are about to be de-wormed!!

The little-known student loan middlemen who are threatening debt forgiveness - MarketWatch https://www.marketwatch.com/story/the-little-known-student-loan-middlemen-who-are-threatening-debt-forgiveness-11668786732?reflink=mw_share_twitter

#GreedIsAnti-Social

#StudentLoanForgiveness

"For decades, lawmakers shaped policy to benefit for-profit companies, nonprofits and state-affiliated organizations that earned money from the federal student-loan system, sometimes to the detriment of borrowers. Now, threats to these organizations’ bottom line could derail the Biden administration’s debt-cancellation plans.

In their lawsuit asking the court to strike down the debt forgiveness plan, six Republican-led states are arguing that they’ll be harmed by the cancellation program — and therefore have the right to sue over it — in part because it will cut into the revenue of state-affiliated entities that earn money from owning old student loans and servicing new ones.

Attorneys representing the states cite potential harm to more than one of these entities as well as other claims as reasons why they have standing or the right to bring a lawsuit over the debt-cancellation plan. More than anything, it’s the risk to the financial interests of the Higher Education Loan Authority of the State of Missouri, or MOHELA, that appears to have convinced a panel of appellate court judges in the 8th circuit to grant the states’ request to temporarily block the Biden administration’s program while they hear the case.

...

Officials at MOHELA, which services student loans on behalf of the federal government, have said they weren’t involved in the states’ decision to file the lawsuit. Still, the litigation is the latest example of how the interests of these state-affiliated organizations and nonprofits that earn millions of dollars through their participation in the student loan system can impact policy surrounding it — and the fate of millions of borrowers.

“We are in this unusual position where the president’s political opponents have sought to block this enormous piece of higher education policy using this big student loan company as a cudgel,” said Mike Pierce, the executive director of the Student Borrower Protection Center, an advocacy group. “Missouri decades ago created this private sector company to buy up and make loans that were guaranteed by the federal government and that’s a program that hasn’t existed since 2010. But this company has been allowed to exist and compete for federal contracts…and grow and grow and grow until it presents this existential threat to the entire student loan system.”

Part of the student loan system for decades

An integral part of the federal student-loan system for decades, these entities have maintained their involvement in and influence on the program, even as their role has become less crucial, or according to some critics, obsolete.

...

“It was as if you thought you had a roommate who was helping to pay the rent and over time you end up paying the roommate to live there,” said Shireman, who worked on student loan policy both in Congress and at the Department of Education for decades. "

#greedisanti #Studentloanforgiveness

Kam Smith · @kamrsmith

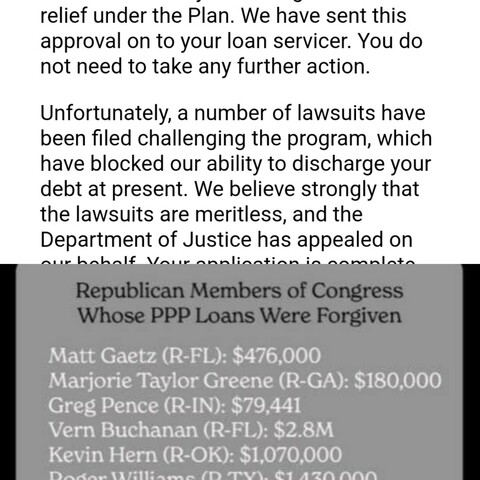

1 followers · 10 posts · Server mastodon.worldWelp - officially got my #Studentloanforgiveness approved but it's held up in court 🙄 . It's so wild to me that I live in a country where the same republican politicians blocking this decision got a free ride. American execptioanlism indeed.

#Studentloanforgiveness #ppploans #studentloans #congress #supremecourt

Caliban64 · @Caliban64

44 followers · 115 posts · Server mastodon.worldUnpopular opinion: I feel for the people left hanging by the court halt to #Biden #Studentloanforgiveness. But I disagree with loan forgiveness. It is unfair to those of us who struggled to save & pay for our own and our kids’ education. If I knew I could get a loan and not pay it I might have done that. Instead we scraped and saved. Meanwhile people I know took out HUGE loans and either defaulted or are waiting to get their loans forgiven. I also pay cash for cars. What’s next, car loan relief?

#biden #Studentloanforgiveness