Jason Sisney 🏳️🌈 · @jasonsisney

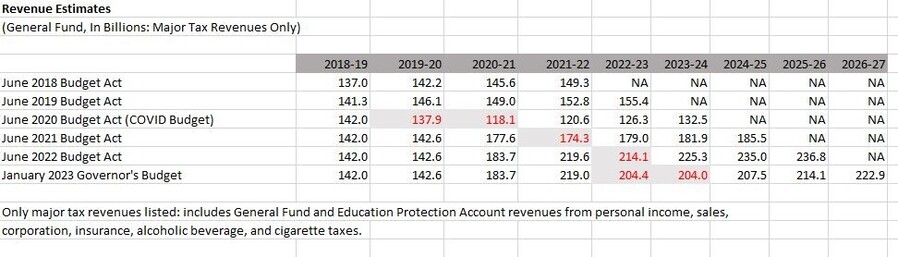

63 followers · 132 posts · Server mastodon.worldPersonal and corporate income taxes in April were a combined $3.8 billion below the Governor's January #CABudget projections. This brings collections for 2022-23 to date down to around $9 billion under levels assumed in the January forecast. The May Revision will update both current fiscal year revenue projections, as well as projections for the next four years.

Jason Sisney 🏳️🌈 · @jasonsisney

63 followers · 131 posts · Server mastodon.worldFeel free to send me any questions you have today on the #CABudget process. I will try to answer any questions I can on California’s state budget. Have a great Coronation Weekend!

Jason Sisney 🏳️🌈 · @jasonsisney

63 followers · 130 posts · Server mastodon.worldFollowing budget committee hearings in both houses and recent months' subcommittee hearings on elements of the package, early action #CABudget bills AB 100 and ABs 110-113 passed the Legislature this morning.

The next #CABudget votes on the Floor of the Legislature are likely the week of June 15, as required by the State Constitution. Budget subcommittees now will proceed in their process, as the May Revision looms.

For tools to follow the #CABudget: https://jasonsisney.substack.com/p/links-to-key-2023-california-budget

Jason Sisney 🏳️🌈 · @jasonsisney

63 followers · 129 posts · Server mastodon.worldApril was a tough month for #CABudget revenue collections. While the IRS deadline extension affects FTB collections in ways that are difficult to interpret, EDD withholding generally is not affected by the IRS change.

LAO notes that withholding was $705 million lower than the April monthly level projected in the Governor's January budget. The Governor will release revised estimates on or before May 14, as required by law. https://lao.ca.gov/LAOEconTax/Article/Detail/756

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 128 posts · Server mastodon.worldBudget committees' analyses of this week's early action #CABudget bills are online: https://abgt.assembly.ca.gov/sites/abgt.assembly.ca.gov/files/Early%20Action%20Analyses%20Packet.pdf and https://sbud.senate.ca.gov/sites/sbud.senate.ca.gov/files/May_2_2023_Hearing_Agenda_Final.pdf

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 126 posts · Server mastodon.worldEarly action #CABudget bills emerge in print, for expected hearings and Floor action next week. https://jasonsisney.substack.com/p/early-action-cabudget-bills-head

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 125 posts · Server mastodon.worldThe agenda for Wednesday's Assembly Budget informational hearing on the 2023 early action #CABudget package has been posted. Five bills are expected. The bills are likely to go into print late on Friday 4/28. https://abgt.assembly.ca.gov/sites/abgt.assembly.ca.gov/files/May%203%20Hearing%20Agenda.pdf

SB/AB 100 Early Action Budget Bill Jr. (principally clean-up provisions for 2022 Budget Act)

SB/AB 110 Child Care

SB/AB 111 State Tax Clarifications for Student Loan Debt Relief

SB/AB 112 Hospitals

SB/AB 113 Farmworker Collective Bargaining

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 125 posts · Server mastodon.worldUpcoming: the first & only 2023 #CABudget "early action" package. SB/ABs 100 & 110-115 likely to emerge in print in the coming day or two. Budget subcommittees have discussed farmworker bargaining, student loan tax relief, and other bills for early action.

Assembly Budget scheduled for Wed. May 3 at 2 pm. Senate Budget and Fiscal Review scheduled for Tue. May 2 at 9:30 am. Consult Daily Files for updates.

Early action bills reflect midyear budget adjustments and are passed annually.

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 125 posts · Server mastodon.worldI am asked frequently about deadlines for the #CABudget. The June 15 deadline was modified in Prop. 25 (2010). At LAO, I led the drafting of the voter guide analysis. As noted to voters, there is a June 15 constitutional deadline for the Legislature to send a budget bill to the Governor. The Legislature has met that deadline each year since Prop. 25 passed.

https://clerk.assembly.ca.gov/content/historical-information

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 122 posts · Server mastodon.worldRevenue update: #CABudget personal income tax (PIT) refunds in April are running far, far above estimates. Higher refunds reduce net revenues, and as a result, April revenues may be on track to be a few billion dollars below the Governor's January estimates for this month. That being said, it is entirely possible that refunds are being processed more quickly than projected, which may mean lower-than-projected refunds next month, or that refunds in October will be below estimates.

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 122 posts · Server mastodon.worldApril #CABudget collections update

Collections affected by unprecedented IRS eight-month tax deadline extension until October. Administration monthly receipt forecasts already have been adjusted to attempt to correct for that.

Bottom line: FTB receipts running close to projected trend for the month, while PIT refunds are running well above the monthly projection -- perhaps due to speedier processing than assumed in the projection.

More: https://substack.com/profile/115083538-jason-sisney/note/c-15006658

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 122 posts · Server mastodon.world#CABudget revenues are up from prior years but dropping faster than projected in last year's state budget. The Governor's May Revision -- on or before May 14 -- will update projections.

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 122 posts · Server mastodon.worldWith a strong sales tax month in March, the #CABudget revenue tally for the fiscal year to date remained steady: still running about $4.7 billion (3.7%) below January budget projections as of the end of March. This is nearly identical to the trend reported at the end of February.

Income tax net receipts (already adjusted to attempt to reflect the multimonth IRS deadline extension) continue to lag.

For more: https://dof.ca.gov/wp-content/uploads/sites/352/2023/04/Finance-Bulletin-April-2023.pdf

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 122 posts · Server mastodon.worldGabe Petek, California's Legislative Analyst, has authored a new piece on the issue of tapping reserves to balance the #CABudget this year. https://lao.ca.gov/Publications/Report/4762

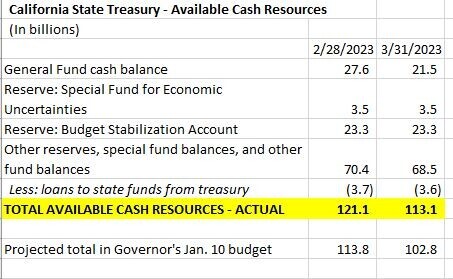

A related issue is the extent to which the state should use borrowing -- from bonds and/or the state's now considerable balances outside the General Fund -- to fund budgeted or planned one-time infrastructure projects. As of March 31, the state treasury had $113 billion of such balances, including the various General Fund reserves.

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 122 posts · Server mastodon.world#CABudget FTB personal income tax collections (before refund claims):

April 1-19, 2022: $12.43 billion

April 1-19, 2023 (IRS payment deadline delay): $4.26 billion, down 66% from last year

Personal income tax refunds:

April 1-19, 2022: $3.69 billion

April 1-19, 2023: $3.97 billion, up 8% from last year

FTB PIT collections seem ahead of the projected trend this month, while refunds are trending considerably higher than projected. Possible refunds are being processed faster this year.

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 115 posts · Server mastodon.worldI will be answering as many #CABudget questions as I can today via all my social media channels: LinkedIn, Substack Notes, Mastodon, and Post. Ask away!

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 114 posts · Server mastodon.worldReflecting the extraordinary 8-month tax deadline extensions from the IRS, income tax collections at California's FTB today are down 77% from last year on April 14. #CABudget

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 114 posts · Server mastodon.worldCalifornia's state finances continue to benefit from unprecedented liquidity in the state treasury. The also unprecedented IRS deadline delay until October is beginning to shrink cash balances as expected. The state has plenty of cash on hand to deal with the likely delay in most quarterly and 2022 income tax payments until October. #CABudget

Jason Sisney 🏳️🌈 · @jasonsisney

62 followers · 114 posts · Server mastodon.worldMarch #CABudget income taxes 10% below projections. https://jasonsisney.substack.com/p/march-income-taxes-10-below-projections

Alchemist CDC - Sacramento, CA · @alchemistcdc

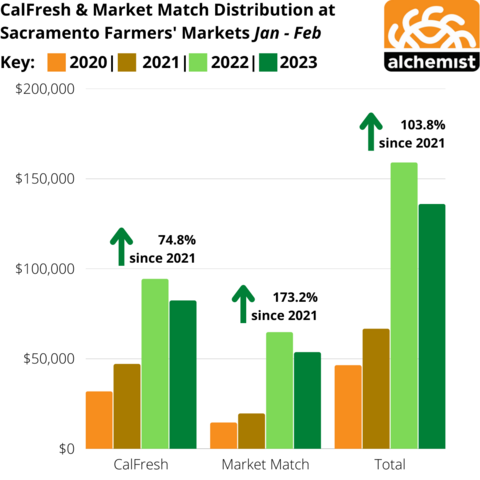

66 followers · 61 posts · Server sfba.socialWe've got numbers for all of you who enjoy tracking data! In Jan/Feb 2023, we have distributed $135,913 in CalFresh and #MarketMatch (MM) at 6 local farmers' markets across 5,475 transactions!

You may note that the total dollar amount is a slight decrease from the same period in 2022. We can trace this to two root causes:

1. Until April '22, MM incentives were $15/customer. Since then, they have been $10/customer. This means fewer incentive dollars are available to spend in '23.

2. The weather was dramatically different between 2022 and 2023. This year, markets saw constant storms that sometimes resulted in early closures or even cancellations, which are normally very rare. The storms also impact the timing and availability of California-grown produce.

(1/2)

#FarmToFork #FarmToEveryFork #WeAreFarmToFork #VisitSacramento #LEAFSB907 #MyJobDependsOnAg #caleg #cabudget #caleg

#marketmatch #FarmtoFork #FarmToEveryFork #wearefarmtofork #visitsacramento #leafsb907 #myjobdependsonag #caleg #cabudget