jrosenberg · @jrosenberg

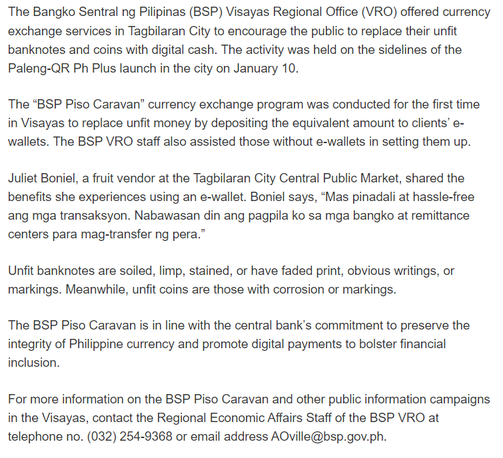

14 followers · 106 posts · Server mstdn.socialBangko Sentral ng Pilipinas (BSP, Philippines), BSP Replaces Unfit Currency with Digital Cash in Tagbilaran, January 16, 2023

— Available here: https://www.bsp.gov.ph/SitePages/MediaAndResearch/MediaDisp.aspx?ItemId=6588

#digitalassets #digitalcash #ewallets #currency #banknotes #digitalpayments #banking #paymentsystems #BangkoSentralngPilipinas #BSP #Philippines #centralbanks

#centralbanks #philippines #BSP #BangkoSentralngPilipinas #paymentsystems #banking #DigitalPayments #banknotes #currency #ewallets #DigitalCash #digitalassets

GOwin · @gowin

137 followers · 1147 posts · Server social.tchncs.deI'm curious about user behavior re the use of #eWallets for #MicroPayments

Do you only (usually) use the same #eWallet brand to pay recipients using the same eWallet?

Does that even matter where you're from? Feel free to elaborate by adding a reply.

In the #Philippines, for example, people usually pay #Gcash to Gcash / or #Maya to Maya because of zero transaction fees. A transaction with another wallet (e.g. Maya to Gcash) may cause a few extra bucks - which adds up, if you use it a lot.

#maya #Gcash #philippines #ewallet #micropayments #ewallets

GOwin · @gowin

137 followers · 1147 posts · Server social.tchncs.de@evelyn

Yep. That's the #QRph logo, and yes it *should* work with other #ewallets that operate in the #Philippines.

Evelyn🚲葉美華 · @evelyn

425 followers · 2591 posts · Server masto.evelynyap.com@rom @gowin @cedled

Question for you guys (see attached image): Isn't this little blue-yellow-red logo in the center of the #QRcode the #QRph logo, and not owned by #GCash? Which means it should* work with other* #eWallets?

I asked the cashier if I could pay with #Maya 📱👛 "Hindi puwede." 😕

I hate it when the only payment options are cash and Gcash. I like to save my cash -- trying to minimize visits to the ATM, to avoid crooks -- and #iHateGlobe.

#qrcode #qrph #gcash #ewallets #maya #IHateGlobe

GOwin · @gowin

137 followers · 1147 posts · Server social.tchncs.deGOwin · @gowin

132 followers · 1084 posts · Server social.tchncs.de@evelyn Basically, the BSP mandated all banks and #ewallet service providers to inter-operate with each other by using a common #QRph standard, piggybacking on #PesoNet and #InstaPay. In theory, consumers no longer need not maintain different apps or #eWallets to transfer funds to each other, but in reality, some consumers find the transaction fees a turn-off, especially if they do a lot of inter-wallet transactions.

#ewallets #instapay #pesonet #QRph #ewallet

GOwin · @gowin

123 followers · 978 posts · Server social.tchncs.deExcept for a handful, too many banks in the #Philippines charge very high transaction fees involving other banks, or #ewallets

How high? According to this [0] document, the actual cost of #instapay fees is only 3 PHP (0.05 USD) , and yet many charge consumers between 10 PHP up to 25 PHP **per** transaction.

As for #pesonet, I read elsewhere that their cost is even lower than 3 PHP.

[0]: https://bfaglobal.com/wp-content/uploads/2022/08/Highlights-emerging-from-Philippines.pdf

#pesonet #instapay #ewallets #philippines

GOwin · @gowin

114 followers · 765 posts · Server social.tchncs.de@cendawanita Sorry, that's the exchange rate for the USD, for reference.

The average transaction fees for #ewallets is 0.30 USD.

GOwin · @gowin

114 followers · 765 posts · Server social.tchncs.de@cendawanita Well, I'm not sure what this government is thinking, but they don't appear to be encouraging the use of #ewallets.

Like I wrote earlier, there are free options for adding money to your eWallet, BUT all options for taking your money out -- yep, you guessed it right, will have additional fees involved.

So, most people think it's too bothersome (and expensive).

GOwin · @gowin

107 followers · 705 posts · Server social.tchncs.deThe #QRph code is the #Philippines' Bangko Sentral's way of ensuring compatibility across #eWallets in the market.

It may be interoperable, but service providers still charge transaction fees for moving funds to other eWallets.

I found that #SeaBank's app works for #GCash, #Maya or whatever #bank/#eWallet that supports the #QRph standard, and they DO NOT charge ridiculous fees (for now?) for the transactions

My #Ilocano forebears will be proud of me 😤 :mastocelebration:

#ilocano #bank #maya #Gcash #seabank #ewallets #philippines #QRph