Hari Tulsidas :verified: · @haritulsidas

186 followers · 1158 posts · Server masto.aiNature loss is a financial risk, and businesses need to act now. A new report warns that the loss of biodiversity and ecosystem services could cost the global economy $10 trillion by 2050. The report also provides a framework for businesses to measure and manage their impacts and dependencies on nature.

#NatureLoss #FinancialRisk #Biodiversity https://www.weforum.org/agenda/2023/06/nature-loss-financial-risk-biodiversity/?utm_source=flipboard&utm_content=HariTulsidas%2Fmagazine%2FArchetypes

#natureloss #financialrisk #biodiversity

Sangeet Kaur · @law_sangeet_kaur

53 followers · 172 posts · Server mastodonapp.ukThe effect of climate litigation is beginning to show as this The Guardian exclusive, written by Isabella Kaminski, reveals. Whoever is still saying that #climatelitigation does not pose a real #financialrisk, should think again.

#climatelitigation #financialrisk #FossilFuels

Itamar Medeiros · @designative

393 followers · 2202 posts · Server mastodon.social#UK-based environmental #LawFirm ClientEarth is suing Shell’s 11-member board, saying they are failing to properly manage the business risks associated with #ClimateChange. The lawsuit, filed in England’s high court, claims that the company’s current climate strategy is inadequate, which puts Shell at a #FinancialRisk as the world works to move away from #FossilFuels. https://gizmodo.com/shell-sued-failing-to-prepare-for-climate-change-1850098944

#uk #lawfirm #climatechange #financialrisk #fossilfuels

jrosenberg · @jrosenberg

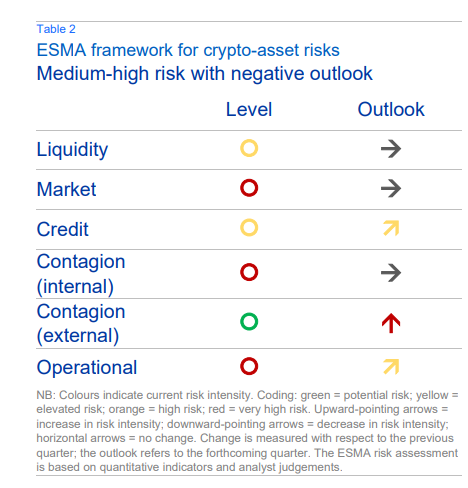

15 followers · 138 posts · Server mstdn.socialEuropean Securities and Markets Authority (ESMA), Trends, Risks and Vulnerabilities (TRV) Report, February 9, 2023

— Available here: https://www.esma.europa.eu/sites/default/files/library/ESMA50-165-2438_trv_1-23_risk_monitor.pdf

#cryptoassets #digitalassets #cryptocurrency #regulation #banking #financialservices #riskmanagement #operationalrisk #financialrisk #financialstability #governance #securities #financialmarkets #ESMA #EuropeanUnion #Eurosystem #Europe

#Europe #Eurosystem #EuropeanUnion #esma #financialmarkets #securities #governance #financialstability #financialrisk #operationalrisk #riskmanagement #financialservices #banking #regulation #Cryptocurrency #digitalassets #cryptoassets

jrosenberg · @jrosenberg

15 followers · 138 posts · Server mstdn.socialGerardo Uña, Alok Verma, Majid Bazarbash and Naomi N Griffin, Fintech Payments in Public Financial Management: Benefits and Risks, International Monetary Fund, Working Paper No. 2023/020, February 3, 2023

— Available here: https://www.imf.org/en/Publications/WP/Issues/2023/02/03/Fintech-Payments-in-Public-Financial-Management-Benefits-and-Risks-529100

#fintech #payments #digitalplatforms ##paymentsystems #mobilemoney #digitalmoney #operationalrisk #financialrisk #riskmanagement #publicsector #financialmanagement #treasurypayments #taxcollection #cashmanagement #IMF

#imf #cashmanagement #taxcollection #treasurypayments #financialmanagement #publicsector #riskmanagement #financialrisk #operationalrisk #digitalmoney #MobileMoney #paymentsystems #digitalplatforms #payments #fintech

Minh Trinh · @ai4good

189 followers · 479 posts · Server mastodon.onlineAs #banks are better capitalized and risk managed after the #GFC (global financial crisis), #financialrisk has migrated to #NBFIs, nonbank financial institutions, #hedgefunds, #pensionfunds, #insurancefunds, and market-based funding in general with less visibility and granular data for regulators:

Linda S. Goldberg from the NY Fed 2022 gives the #IMF Mundell-Fleming Lecture: Global #Liquidity: Drivers, #Volatility and Toolkits

https://www.youtube.com/watch?v=MpCzTFX31Cc

#volatility #liquidity #imf #insurancefunds #pensionFunds #hedgefunds #nbfis #financialrisk #gfc #banks