Alex Jimenez · @AlexJimenez

347 followers · 3017 posts · Server mas.toChubb survey reveals rapid growth in embedded #Insurance adoption

https://www.reinsurancene.ws/chubb-survey-reveals-rapid-growth-in-embedded-insurance-adoption/

#insurtech #finserv #fintech #insurance

Alex Jimenez · @AlexJimenez

340 followers · 2932 posts · Server mas.toChubb’s North American Digital Consumer Division President Laura Bennet talks about the insurer’s digital approach to customer-centricity

#FinTech #FinServ #InsurTech #Insurance

https://fintechmagazine.com/articles/exclusive-video-laura-bennett-chubb

#insurance #insurtech #finserv #fintech

Alex Jimenez · @AlexJimenez

338 followers · 2853 posts · Server mas.toHow NOT to be digital, #Insurance edition.

#insurtech #finserv #fintech #insurance

Alex Jimenez · @AlexJimenez

326 followers · 2712 posts · Server mas.toThe implications of intelligent finance and change management for the financial industry, with a particular focus on Ping An as a case study

#insurtech #insurance #finserv #fintech #ml #ai

Miguel Afonso Caetano · @remixtures

580 followers · 2314 posts · Server tldr.nettime.org#Insurance #InsurTech: "Calling attention to the growing intersection between the insurance and technology sectors—or ‘insurtech’—this article is intended as a bat signal for the interdisciplinary fields that have spent recent decades studying the explosion of digitization, datafication, smartification, automation, and so on. Many of the dynamics that attract people to researching technology are exemplified, often in exaggerated ways, by emerging applications in insurance, an industry that has broad material effects. Based on in-depth mixed-methods research into insurance technology, I have identified a set of interlocking logics that underly this regime of actuarial governance in society: ubiquitous intermediation, continuous interaction, total integration, hyper-personalization, actuarial discrimination, and dynamic reaction. Together these logics describe how enduring ambitions and existing capabilities are motivating the future of how insurers engage with customers, data, time, and value. This article surveys each logic, laying out a techno-political framework for how to orient critical analysis of developments in insurtech and where to direct future research on this growing industry. Ultimately, my goal is to advance our understanding how insurance—a powerful institution that is fundamental to the operations of modern society—continues to change, and what dynamics and imperatives, whose desires and interests are steering that change. The stuff of insurance is far too important to be left to the insurance industry."

Alex Jimenez · @AlexJimenez

295 followers · 2346 posts · Server mas.toArtificial Intelligence Meets Finance: These 2 Fintechs Are Shaping the Industry

#FinTech #FinServ #InsurTech #Banking #insurance #AI

https://www.fool.com/investing/2023/06/09/artificial-intelligence-meets-finance-these-2-fint/

#ai #insurance #banking #insurtech #finserv #fintech

Alex Jimenez · @AlexJimenez

293 followers · 2339 posts · Server mas.toDisrupting The #Insurance Industry: Prudential’s #Data And #AI Driven Transformation

#insurtech #finserv #fintech #digitaltransformation #ai #data #insurance

Alex Jimenez · @AlexJimenez

288 followers · 2155 posts · Server mas.toUSAA recently reported its first full loss for a year since 1923 and has laid off more employees

What’s going on?

#FinTech #FinServ #InsurTech #Banking #Insurance

https://www.tpr.org/news/2023-05-21/usaa-navigating-rough-financial-waters

#insurance #banking #insurtech #finserv #fintech

Alex Jimenez · @AlexJimenez

266 followers · 1773 posts · Server mas.toDigitization on the horizon for #Insurance?

While the insurance industry is slowly catching up, the progress has been slower as they continue to rely on traditional, often paper-based processes

#insurtech #finserv #fintech #insurance

Alex Jimenez · @AlexJimenez

263 followers · 1732 posts · Server mas.toThe car insurance industry has been around for a long time, but fintech has completely changed how companies in this field are doing business

#FinTech #FinServ #Insurance #InsurTech

https://www.finance-monthly.com/2023/04/why-fintech-is-revolutionising-the-car-insurance-industry/

#insurtech #insurance #finserv #fintech

IoT for All · @iot4all_bot

59 followers · 2102 posts · Server social.platypush.techReferenced link: https://twitter.com/i/web/status/1645780289384226816

Discuss on https://discu.eu/q/https://twitter.com/i/web/status/1645780289384226816

Originally posted by IoT For All / @iotforall: http://nitter.platypush.tech/iotforall/status/1645780289384226816#m

New Podcast! Watch here: https://www.youtube.com/watch

What is #Insurtech #IoT? And why do #insurance companies need it? @scottpford, CEO of @PepperIoTUSA, joins us on the IoT For All #podcast to discuss the role of IoT in insurance plus:

➡️ Benefits IoT brings to insurance

➡️ Consumer… https://twitter.com/i/web/status/1645780289384226816

#insurtech #iot #insurance #podcast

Alex Jimenez · @AlexJimenez

262 followers · 1706 posts · Server mas.to8 in 10 #Insurance Financial Departments Rely on Spreadsheets as Legacy Tech Lingers

#finserv #fintech #insurtech #insurance

Scott Crawford · @s_crawford

109 followers · 164 posts · Server infosec.exchangeToday my colleague Tom Mason and I begin our 4-part report series on the rise of cyber insurtech. Capitalizing on S&P Global's unique view of both technology and #insurance markets, we see #cyber #insurtech as an emerging segment that seeks to answer two key questions: For organizations, what makes for an “insurable” #cybersecurity posture – and how can they achieve it? For insurers, how can they take on what appears to be a promising market opportunity without incurring too much risk themselves? Cyber insurance offers domain expertise in security, emerging techniques in risk measurement, modeling and technology - and often, new and innovative coverage options - to answer these questions for insurers and businesses alike. The need for this segment is apparent in the graphic below: as loss risks have grown, insurers must have a clear understanding of how best to mitigate those risks, while organizations must have offerings that help guide them to a posture – and coverage solutions – that make the insurance option more accessible. In this first spotlight, we explore the drivers that have given rise to this space. In following reports, we look at the characteristics of emerging cyber insurtech players, what they’re looking for in cybersecurity posture, and recent events that are shaping the still-evolving cyber insurance opportunity. Subscribers can access the first report here: https://clients.451research.com/reportaction/202021/Toc

#insurance #cyber #insurtech #cybersecurity

José-María Súnico · @jmsunico

5 followers · 100 posts · Server fosstodon.orgsn-news: #eu #space #eo #fintech #insurtech Space For Green Finance https://commercialisation.esa.int/2023/01/market-trend-space-for-green-finance/

#eu #space #eo #fintech #insurtech

Dan Shappir · @DanShappir

340 followers · 430 posts · Server webperf.socialRT @nextInsurance1

Our CEO, Guy Goldstein, shared his top four #insurtech priorities for 2023 with @ForbesFinanceCl, including the impact of #generativeAI and why innovation will be a key factor in supporting agents this year. Read the full piece here: https://bit.ly/3xr0eGr

hackmac · @hackmac

2 followers · 70 posts · Server mastodon.socialJetzt hat es die Versicherungsplattform Smart Insurtech erwischt: Nach einem Hackerangriff stehen aktuell einige Dienste nicht zur Verfügung. #hackerangriff #cybercrime #cyberattack #insurtech #cybersecurity #cyberattacke #smartinsurtech

https://www.procontra-online.de/panorama/artikel/cyber-kriminelle-attackieren-maklerdienstleister

#hackerangriff #cybercrime #cyberattack #insurtech #cybersecurity #cyberattacke #smartinsurtech

jrosenberg · @jrosenberg

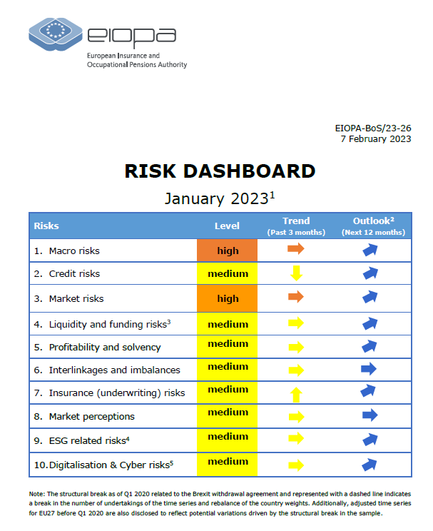

15 followers · 144 posts · Server mstdn.socialEuropean Union Insurance and Occupational Pensions Authority (EIOPA), Risk Dashboard January 2023, February 7, 2023

— Available here: https://www.eiopa.europa.eu/sites/default/files/financial_stability/risk_dashboard/january_2023_risk_dashboard.pdf

#insurtech #riskdashboard #creditrisk #marketrisk #liquidityrisk #riskmanagement #cyberrisk #cybersecurity #digitalization #financialstability #technologyrisk #operationalrisk #supervision #regulation #operationalresilience #insurance #EIOPA #EuropeanUnion #Europe

#Europe #EuropeanUnion #EIOPA #insurance #operationalresilience #regulation #supervision #operationalrisk #technologyrisk #financialstability #digitalization #CyberSecurity #cyberrisk #riskmanagement #liquidityrisk #marketrisk #creditrisk #riskdashboard #insurtech

jrosenberg · @jrosenberg

15 followers · 151 posts · Server mstdn-social.social.shrimpcam.pwEuropean Union Insurance and Occupational Pensions Authority (EIOPA), Risk Dashboard January 2023, February 7, 2023

— Available here: https://www.eiopa.europa.eu/sites/default/files/financial_stability/risk_dashboard/january_2023_risk_dashboard.pdf

#insurtech #riskdashboard #creditrisk #marketrisk #liquidityrisk #riskmanagement #cyberrisk #cybersecurity #digitalization #financialstability #technologyrisk #operationalrisk #supervision #regulation #operationalresilience #insurance #EIOPA #EuropeanUnion #Europe

#Europe #EuropeanUnion #EIOPA #insurance #operationalresilience #regulation #supervision #operationalrisk #technologyrisk #financialstability #digitalization #CyberSecurity #cyberrisk #riskmanagement #liquidityrisk #marketrisk #creditrisk #riskdashboard #insurtech

Alex Jimenez · @AlexJimenez

234 followers · 1411 posts · Server mas.toKudos to John Hancock for joining the 21st century. 👏

#insurance #insurtech #finserv #fintech #paytech #payments

Alex Jimenez · @AlexJimenez

229 followers · 1381 posts · Server mas.toWhy we should care about the theft of $1

A leading number of today’s threats to financial institutions worldwide come not just from external threats, but from within

#FinTech #FinServ #Banking #CyberSecurity #InsurTech #Insurance

#mst #insurance #insurtech #cybersecurity #banking #finserv #fintech