Richard Forrester - 🐦 escapee · @RichForrest2

261 followers · 5220 posts · Server aus.social#watchdog #investigates #homebuilder #auspol

Gates Files · @gatesfiles

25 followers · 88 posts · Server mastodon.worldHappy #TrekTuesday friends. After a little break #InvestiGates is back, serving us magic, laughter and wonderful conversations. This week, #GatesMcFadden sat down with newest #SpaceSon #EdSpeleers.

I’m picturing big hugs, check it out on your fave podcast platform!

#trektuesday #investigates #gatesmcfadden #spaceson #edspeleers

Gates Files · @gatesfiles

23 followers · 70 posts · Server mastodon.worldGrab your ear plugs and enjoy another episode of #InvestiGates in which #GatesMcFadden sat down to talk to #AlexanderSiddig

Maybe they’ll talk medical stuff? Find out, give it a listen on your favorite podcast platform.

#investigates #gatesmcfadden #AlexanderSiddig

PhoenixSerenity · @msquebanh

1328 followers · 13130 posts · Server mastodon.sdf.org#Scotland taught #GaryYounge hard truths about #racism.

Younge is one of Britain’s most celebrated #journalists & #professor of #sociology . He was #Britain ’s 1st #black #NewspaperColumnist, renowned for his work with #TheGuardian. Younge’s #NewBook - Dispatches From The Diaspora, #investigates what it means to be black today.

...Younge learned many of the #lessons which shaped his view of how #BlackPeople are treated in predominantly #WhiteSocieties .

https://www.heraldscotland.com/politics/23396522.men-bats-shouted-n-word-gary-younge-racism-scotland

#scotland #garyyounge #racism #journalists #professor #sociology #britain #black #newspapercolumnist #theguardian #newbook #investigates #lessons #blackpeople #whitesocieties #author #book

Only The Janeway · @OnlyTheJaneway

214 followers · 99 posts · Server mastodon.worldKate Mulgrew is Gates McFadden’s latest guest on her #InvestiGates podcast. Great to hear two iconic women of Trek shooting the breeze. Enjoy! 🖖🏻

🎙️ https://podcasts.apple.com/gb/podcast/gates-mcfadden-investigates-who-do-you-think-you-are/id1566636928?i=1000603109508

#StarTrek #StarTrekVoyager #StarTrekProdigy #StarTrekJaneway #StarTrekPicard #Janeway #Starfleet #KateMulgrew #GatesMcFadden

#investigates #startrek #startrekvoyager #startrekprodigy #startrekjaneway #startrekpicard #janeway #starfleet #katemulgrew #gatesmcfadden

Elena. · @theresmiling

202 followers · 1482 posts · Server sueden.socialI just listened to the recent episode of Gates McFadden‘s podcast #InvestiGates, where she talked to Kate Mulgrew. This was a beautiful conversation. The best one yet. They even talk about The Lamp („Long may it shine!“).

Go go go and listen! Now!

Gates Files · @gatesfiles

18 followers · 57 posts · Server mastodon.worldPremiere day it’s here! 🎉

Stop whatever you’re doing and give a listen to #GatesMcFadden talking to #WilliamShatner

#InvestiGates is guaranteed to give you great experiences, whether you’re working, chilling or even doing activity. 100% tested to work. Enjoy!

#gatesmcfadden #williamshatner #investigates

Gates Files · @gatesfiles

14 followers · 47 posts · Server mastodon.world#GatesMcFadden wearing #InvestiGates t-shirt (the same I have by the way) is PURE GOLD.

Enjoy the 2 HQ photos from SiriusXM visit!

📸 https://gates-mcfadden.com/2023/02/13/cast-of-star-trek-picard-visits-siriusxm/

CHAUNCEY I. BROWN III · @usafirstpatriot

0 followers · 112 posts · Server masthead.socialNew Jersey #Investigates Double #Voting That May Have Flipped Local #Race. https://www.dailywire.com/news/new-jersey-investigates-double-voting-that-may-have-flipped-local-race

TastingTraffic Social® · @InternationalTechNews

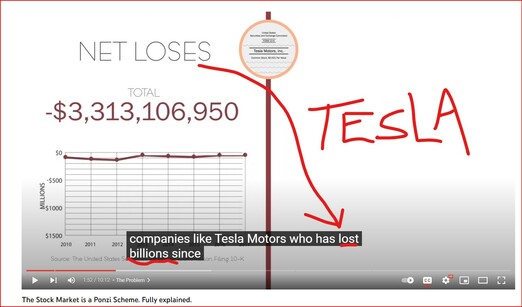

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

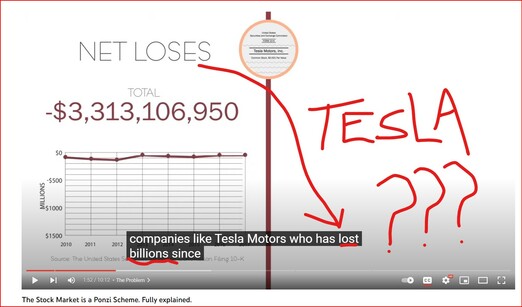

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of #capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #capital_gains #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1465 posts · Server tastingtraffic.netThe #Ponzi Factor | The #Stock_Market is a #Ponzi_Scheme EXPLAINED.

NOTE: #Stock_buybacks are #NOT returns/dividends because the firms just #print_shares after the #buyback AKA #DILUTION

The Ponzi Factor is the most #comprehensive research #ever_compiled on the #negative_sum nature of capital_gains—the money #people make from buying and selling stocks. Unlike other finance books, this book does not #assume stocks are #ownership_instruments. It #investigates the #ownership_assumption and asks, “Why are stocks ownership instruments if the owners #never_receive_money from the companies they #own?” Most people don't #realize that #profits from buying and selling stocks come from #other_investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook #never #pay their #investors. Their #investors_profits are #dependent on the inflow of money from #new_investors, which by #definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #Ponzi #stock_market #PONZI_SCHEME #Stock_buybacks #not #print_shares #buyback #DILUTION #comprehensive #ever_compiled #negative_sum #people #assume #ownership_instruments #investigates #ownership_assumption #never_receive_money #own #realize #profits #other_investors #google #telsa #facebook #NEVER #PAY #investors #investors_profits #dependent #new_investors #definition #SEO #RTB #HFT