MDonaldson → · @qburns

673 followers · 2508 posts · Server mas.tonot #sure if you #realize this but when you #post a #paragraph #littered with #pointless #hashtags it gives #me and my #friends a #throbbing #headache if we #choose to #read it

#read #choose #headache #throbbing #friends #me #hashtags #pointless #littered #paragraph #post #realize #sure

🏳🌈Terminal Impala (He/Him) · @terminalimpala

81 followers · 1928 posts · Server me.dmThe right-wingers are boycotting this music and that TV show, etc.

Eventually they'll only be able to listen to the sound of the #wind, #creeks, #birds. They'll only be able to watch the #trees, the #mountains, the #frolicking #deer. And then...

... they'll #realize...

... that they've turned into #woke #treehuggers and will go #insane at the thought.

#RightWingers #USPolitics #boycott #prediction #queer #lgbtq #lgbtqia

#wind #creeks #birds #trees #mountains #frolicking #deer #realize #woke #treehuggers #insane #rightwingers #uspolitics #boycott #prediction #queer #lgbtq #lgbtqia

Nando161 · @nando161

583 followers · 28827 posts · Server kolektiva.social"I need #people to #realize "gay #men who barely consider themselves men except as a matter of convenience and #sexual compatibility #logistics" are not some niche #esoteric #Tumblr #mastodon thing but a condition an unquantifiably vast portion of us share. Privilege discourse is good when you know what you're talking about, but many are so #dogmatic about it they end up viewing men and #women as #different #species and #nonbinary #people as a neatly delineated third species."

https://www.tumblr.com/theanartist/717575051153637376?source=share

#people #realize #men #sexual #logistics #esoteric #tumblr #mastodon #dogmatic #women #different #species #nonbinary #AusGov #politas

Chrissy · @chrissytina

7 followers · 93 posts · Server mastodon.worldguyinahat · @werefreeatlast

139 followers · 1187 posts · Server mastodon.socialI tell you what though. If you're not 40 yet, you would do yourself a big favor by #eating less, #exercising and by not eating any kind of meat or #meat products. No #pork, #fish, #cow, dog or anything like that. When you do, immediately you will #realize how crazy the world is on making you #eat those things.

#eating #exercising #meat #pork #fish #cow #realize #eat

Shannon Green · @shannongreen

20 followers · 221 posts · Server universeodon.com@KeithJChouinard I think I know what you mean. The saying "you don't know what you don't know" may fit well here. It is similar to say... the #phenomena of #color #blindness.

If you are #colorblind and cannot #perceive a color you may never #realize you do not perceive it, rendering your #perception of your #experience of the world literally not as #clear as others. You may even possibly struggle at certain aspects of life. You may only realize there is something more happening after someone finds a way to prove to you that they see the same thing differently.

There are #tools to help you see more clearly if you realize your color blindness.

Interestingly, I just looked it up, approximately 60% of people don't realize they are color blind.

I'm sure the that percentage is much higher for those who are #unaware of their #extrasensory #perception.

#spirituality #spiritual #higherself #claires #clarity of #spirit #soul #connection #consciousness

#phenomena #color #blindness #colorblind #perceive #realize #perception #experience #clear #tools #unaware #extrasensory #thestruggleisreal #spirituality #spiritual #higherself #claires #clarity #spirit #soul #connection #consciousness

Nando161 · @nando161

258 followers · 8333 posts · Server kolektiva.socialAlike unto Oracular Wisdom · @richardmcsweeney

7 followers · 36 posts · Server mastodon.worldThere, he very gently rolled the tub over with his nose thus allowing the fish to safely wiggle and slide on into the waters. With leaping this way and that way in the water, the fish thanked the great deer for his understanding and kindness. And the deer feeling very happy to be of help returned to sipping of the waters.

#auow #ireland #nowreading #childrensliterature #storytime #gently #gentle #gentleness #understanding #appreciate #realize #acknowledge #ACoIre35

#auow #ireland #nowreading #childrensliterature #storytime #gently #gentle #gentleness #understanding #appreciate #realize #acknowledge #acoire35

TastingTraffic Social® · @InternationalTechNews

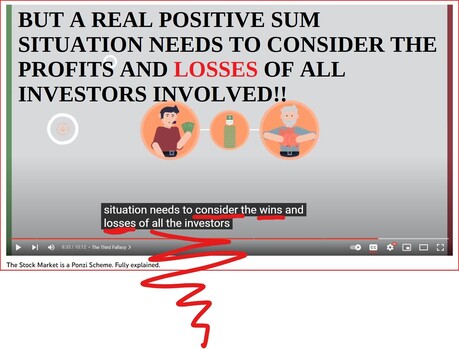

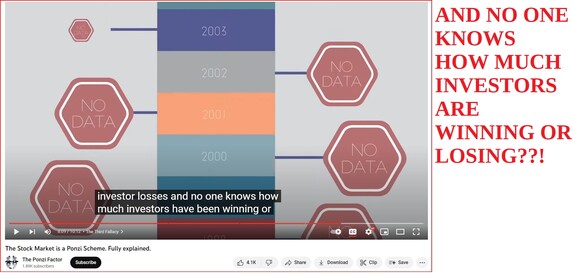

17 followers · 1519 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1518 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1517 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1516 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1515 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1514 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1513 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1512 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1511 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1510 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1509 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT

TastingTraffic Social® · @InternationalTechNews

17 followers · 1508 posts · Server tastingtraffic.netThe #Stock_Market is a #PONZI_SCHEME EXPLAINED

The #Ponzi_Factor is the most #comprehensive_research #EVER_COMPILED on the #negative_sum nature of #capital_gains—the #money people make from #buying and #selling_stocks.

Unlike other finance books, this book does not assume stocks are ownership instruments.

It investigates the ownership assumption and asks, “Why are #stocks_ownership_instruments if the owners never receive money from the companies they own?”

Most people don't #realize that #profits from buying and selling stocks come from other investors.

When one investor buys low and sells high, another investor is also buying high and needs to sell for even higher.

Companies like #Google, #Telsa, #Facebook never pay their investors. Their investors' profits are dependent on the inflow of money from new investors, which by definition, is how a #Ponzi_scheme works.

History shows that the association between stocks and ownership came through dividends—a profit-sharing agreement between the shareholders and the businesses they owned, which is also why all stocks paid dividends before the 1900s. The idea of non-dividend stocks is a new concept that came about over the past century. At some point, the academics and regulators decided it was okay for companies to issue stocks and avoid paying their investors indefinitely. But their acceptance of this new form of ownership—Ponzi assets—was through tradition (and possibly corruption), but not with any research or logic.

The sad truth is, people in finance do not study history and don’t know the difference between a value that comes from the exchange of money (a cerebral idea) and the money that is being exchanged (a possessable item). The product of this ignorance is a system and culture that treats Ponzi assets as ownership just because they’re printed by a company. It doesn’t matter if the company makes money, losses money, pays nothing, or prints as many shares as they want. If a company prints it, it’s ownership. This kind of shoddy logic doesn’t work in other industries, but it is the norm in finance.

TastingTraffic LLC

Founder of #SEO (Search Engine Optimization)

Founder of #RTB (Real Time Bidding)

Founder of #HFT (High Frequency Trading)

Disclaimer: https://tastingtraffic.net and/or http://JustBlameWayne.com (Decentralized SOCIAL Network) and/or its owners [http://tastingtraffic.com] are not affiliates of this provider or referenced image used. This is NOT an endorsement OR Sponsored (Paid) Promotion/Reshare.

#INTERNATIONAL_TECH_NEWS #stock_market #PONZI_SCHEME #ponzi_factor #comprehensive_research #ever_compiled #negative_sum #capital_gains #money #buying #selling_stocks #stocks_ownership_instruments #realize #profits #google #telsa #facebook #SEO #RTB #HFT