Alaric Aloor🐕🏎⚽️🥃 · @alaric

1645 followers · 1933 posts · Server ioc.exchangeRemember the All in Pod *financial arsonists* (S$cks, C$l$c$Nia) and how *they caused* the SVB bank run and the proclamations of financial meltdown with their *freak out and drama* on Whatsapp/Slack?

That was on March 10th. 3 WEEKS AGO

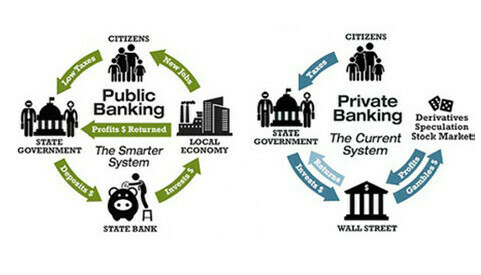

Public Bank East Bay · @publicbankeastbay

9 followers · 8 posts · Server sfba.socialBuild Public Banks as Response to SVB & Signature Bank Failures, by @nathansnewman

#PublicBank #PublicBanking #SVB #SVBcrash #SVBcollapse #SVBBank #SVBfail

https://open.substack.com/pub/nathannewman/p/build-public-banks-as-response-to?utm_campaign=post&utm_medium=web

#publicbank #publicbanking #svb #svbcrash #svbcollapse #svbbank #svbfail

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1616 followers · 1990 posts · Server ioc.exchangeSpeaking of SPACs, the SPAC that agreed to buy Truth Social fired its chairman and CEO...LOLLLLL

The deal remains stalled.

"On March 19, 2023, the board of directors (the “Board”) of Digital World Acquisition Corp., a Delaware corporation (the “Company”), terminated Patrick Orlando from his positions as Chairman and Chief Executive Officer of the Company. Mr. Orlando remains a director of the Company."

https://www.sec.gov/ix?doc=/Archives/edgar/data/1849635/000119312523076343/d480278d8k.htm

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1614 followers · 1988 posts · Server ioc.exchangeAh, SPACs, we barely knew thee.

The link, from 2021, is how SVB looked at SPACs.

"The IPO process has seen little innovation, and for some companies thinking about going public, SPACs can provide useful tools to raise capital quicker and with fewer hurdles based on current market conditions.

From our perspective, it is advantageous to have capital flow options and innovation in fundraising with new or revised approaches, especially in a time of huge demand for new solutions to address global challenges."

Good times 🙄

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1608 followers · 1997 posts · Server ioc.exchangeA part of the fallout from the failure of SVB, and the issues with banks dealing with startups and VCs, is that a lot of cybesecurity product firms are going to end up failing this year or get bought out by PE firms because they have, for a while now, subsisted on the "free/easy money" provided by VCs. The days of hemorrhaging cash and not providing value to their customers is over. Profitability is going to be more important now than "growth at all costs" . Raising capital is going to be significantly harder now or even impossible given that the proverbial well is drying up for the foreseeable future.

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1608 followers · 1998 posts · Server ioc.exchange#SVB #SVBFail #CreditSuisse #FirstRepublic

First Republic, which continues to say that it has enough liquidity, is being advised by JP Morgan on "strategic alternatives" 👇🏾

Some analysts believe that First Republic Bank must raise funds or sell itself because it would have suffered, according to them, similar losses to Silicon Valley Bank.

#svb #svbfail #creditsuisse #firstrepublic

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1608 followers · 1996 posts · Server ioc.exchangeIt must be nice to have a business model that emphasizes "growth at all costs" and "disrupting" verticals with easy access to VC and investor 💵s but now having the "need" to become profitable. The VC model is broken and either needs to be done away with or totally reformed.

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1605 followers · 1998 posts · Server ioc.exchangePretty apt Asimov quote given the situation with SVB and Credit Suisse 👇🏾

What is really amazing, and frustrating, is mankind's habit of refusing to see the obvious and inevitable until it is there, and then muttering about unforeseen catastrophes.

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1604 followers · 1995 posts · Server ioc.exchangeThis, by, @molly0xfff is brilliant 👇🏾

She calls out the massive 💩stains S&cks & C&l&c&nis for their blatant hypocrisy

https://newsletter.mollywhite.net/p/the-venture-capitalists-dilemma

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1605 followers · 1992 posts · Server ioc.exchangeUBS Agrees to Buy Credit Suisse for More Than $3 Billion👇🏾

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1605 followers · 1991 posts · Server ioc.exchange$2 Billion is *much closer to the $9.5 billion friday close of business valuation than $1 Billion. This place should have been sold for parts years ago.

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1605 followers · 2000 posts · Server ioc.exchangeUBS makes $1 billion all-share offer for embattled Credit Suisse 👇🏾

Credit Suisse is a penny stock

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1603 followers · 1994 posts · Server ioc.exchangeGood Marketplace episode on how in the early hours of Silicon Valley Bank’s collapse, the news spread like wildfire through startup messaging chains on WhatsApp, Slack, Signal and Telegram.

Bank runs fueled by social media fueled by rumors and anxiety among the VC bros 👇🏾

https://podcasts.apple.com/us/podcast/marketplace/id201853034?i=1000604709880

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1603 followers · 1995 posts · Server ioc.exchange15 years ago, in a deal coordinated by ministers, the Swiss National Bank and federal banking commission, the Swiss government effectively pumped $60bn into UBS, taking virtually the last $50bn of its toxic assets into a special purpose vehicle off its books and owned by the SNB. Today, they are urging UBS to explore an acquisition of all or parts of Credit Suisse Group AG after Credit Suisse pummeled by a "crisis of confidence" aka multiple scandals including mismanagement of funds, the bank closed the 2022 fiscal year with a loss of nearly $8 billion, its biggest loss since the 2008 global financial crisis, preventing money laundering among others but yes "crisis of confidence" 🙄

Lobbying by the financial industry plays a huge part in why regulation and supervision of the largest financial institutions in the United States and around the world is extremely insufficient.

https://finance.yahoo.com/news/ubs-explore-credit-suisse-deal-231127876.html

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1603 followers · 2005 posts · Server ioc.exchange#SVB #SVBFail #uspol #uspolitics

Bank run organized and orchestrated on Slack/Whatsapp by panicked VC bros high on their own supply and then tweeting about how "if the government didn't step in, it would be chaos and the end of innovation ", reminded me of this Albert Einstein quote 👇🏾

An oligarchy of private capital cannot be effectively checked even by a democratically organized political society because under existing conditions, private capitalists inevitably control, directly or indirectly, the main sources of information.

#svb #svbfail #uspol #uspolitics

SCOFIELD!®️⛈ · @scofield_fx

5 followers · 342 posts · Server ioc.exchange

jack · @j4ck

86 followers · 776 posts · Server iosdev.spaceAlaric Aloor🐕🏎⚽️🥃 · @alaric

1603 followers · 2018 posts · Server ioc.exchangeAbout herd mentality, bank runs started via Slack/Whatsapp (social), and the ghoul behind 🤡s Vance, Masters and now, Ramaswamy.

“nobody on Earth is more of a herd animal than Silicon Valley venture capitalists”

- Matt Levine

(see screen shot) 👇🏾

"Peter Thiel started the bank run. All of his companies got their money out. Most of their competitors did not get their money out. Many of those competitors might not have survived the week of the FDIC hadn’t stepped in.

I’m not saying he nefariously intended to bring the bank down in order to gain an advantage over his competitors. I wouldn’t put it past him, but I also don’t think there’s much reason to grant him supervillain-level foresight here. (He seems more like a run-of-the-mill villain to me.)"

https://davekarpf.substack.com/p/three-thoughts-on-silicon-valley

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1602 followers · 2001 posts · Server ioc.exchangeBank lends our more money than it in deposits from customers, investors keep investing money because, "why not?" and then are "spooked" when the facts come out.

A *fascinating industry!

https://www.cnn.com/2023/03/16/investing/first-republic-bank

Alaric Aloor🐕🏎⚽️🥃 · @alaric

1602 followers · 1999 posts · Server ioc.exchangeCredit Suisse got $54 Billion from the ECB after it failed to disclose "material weaknesses in internal controls and the significant outflows."

"Although Hwang’s history of risky behavior and illegal trading conviction was no secret, the prospect of squeezing an extra buck seems to have been too enticing for the world’s largest banks to miss. It’s almost as if the Financial Crisis of 2007-2008 and the subsequent bank bailouts never happened as a lesson-learning opportunity."

Article is from 2021👇🏾

Credit Suisse in a $4.7 Billion Bind Thanks to Hwang’s Leveraged Bets

https://tokenist.com/credit-suisse-4-billion-bind-thanks-hwang/

Narrator: Nothing was learned 🙄