BeePS · @BPStuart

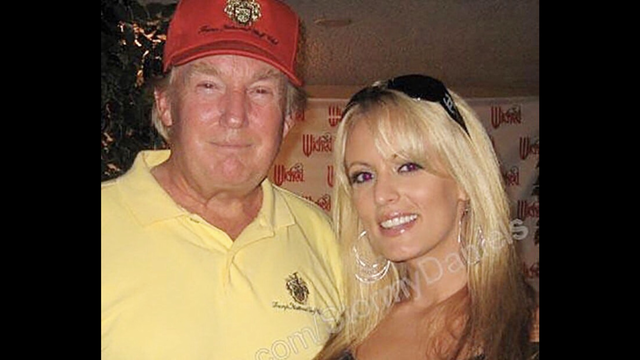

316 followers · 1852 posts · Server mstdn.socialHey, Trump!

The continued visibility of this “Stormy” weather must make for increasingly cold climes between you and Melania. It can’t be helping your pre-nip situation any. If you’re not careful, Melania may end up talking you for all you’re… not worth.

#HeyTrump #DonaldTrump #StormyWeather #THushMoney #TrumpCheats

#trumpcheats #thushmoney #stormyweather #DonaldTrump #heytrump

swtyndall.notwhatwethink · @notwhatwethink

444 followers · 1612 posts · Server climatejustice.socialOf course Trump cheated on his taxes, he also lies all the time. Anyone who is surprised has not been paying attention to his character all along.

Trump and the IRS: A massive tax cheat and a hapless, corrupt agency | Salon.com https://www.salon.com/2022/12/21/and-the-irs-a-massive-cheat-and-a-hapless-corrupt-agency/

...The committee released a report on its findings Tuesday night...The first big takeaway is that the IRS, which is supposed to audit all presidential tax returns under the Mandatory Presidential Audit Program, never even got around to looking at Trump's. It was only after the committee began its inquiries in 2019 that the IRS finally opened an investigation of Trump's 2016 returns, even though it had been tasked by that time with auditing him from 2015 through 2018.

That's very strange, to put it mildly, and it certainly validates the committee's stated premise for opening the case. Its members are now recommending that the Mandatory Audit Program, which has been in place since the Carter administration, be codified into law.

...

So what we now know is that the IRS did not even begin its mandatory audits of Trump's taxes until 2019 and has completed none of them. So the returns the committee finally has in its possession are missing the backup information that would routinely have been requested of any return under audit to prove the legitimacy of its claims. So there are many unanswered questions about the validity of Trump's numbers, although we already about his sleazy tax avoidance schemes through the myriad lawsuits and criminal proceedings he has faced, as well as voluminous reporting by the New York Times and others.

Back in 2018, the Times reported on a trove of Trump family financial documents, including tax returns of Fred Trump, the ex-president's father. Fred had evidently gone to huge lengths to pass large sums to his children through dubious or outright illegal methods, mostly to evade paying taxes over many years. His son has apparently followed that tradition for many years. That issue has come up both in the investigation of these tax returns and in the recent criminal case against the Trump Organization, in which the family business was found guilty of nine criminal counts including tax fraud. It also features prominently in the New York attorney general's civil case against Trump and three of his adult children.

In 2020, the Times came into possession of more Trump tax returns, including some of those the committee will be release this week. The story they told was pretty stunning:

Donald J. Trump paid $750 in federal income taxes the year he won the presidency. In his first year in the White House, he paid another $750. He had paid no income taxes at all in 10 of the previous 15 years — largely because he reported losing much more money than he made.

Perhaps the most intriguing detail in that story was that Trump was in fact still embroiled in an audit from 2009, with the IRS questioning the validity of a $72.9 million tax refund he received after declaring huge losses. If the IRS eventually ruled against him, the Times reported, he could end up owing more than $100 million.

...

But it's clear enough why he didn't want to. The story those returns clearly tell is of a man who publicly bragged that his businesses were hugely successful even as he claimed massive losses. He was afraid of being seen as the phony he is and was worried, reasonably enough, that the audit would expose him as a tax cheat who owed the government $100 million that he probably doesn't have.

...

This is the man who refused to divest himself of his businesses the whole time he was in the White House, which is also massively unethical. If Trump was hiding something during his tenure, as he pretty clearly was, the public has a right to know about it. After all, he's running again. I think we can feel fairly confident that he'll never come clean voluntarily.

The committee's report also shows that something is very wrong at the IRS, which appears to be understaffed and unqualified to deal with big-money malefactors' labyrinthine financial schemes. That can theoretically be fixed by staffing up the agency and recruiting people who know what they are doing and have enough oversight so there's less chance of corruption and cronyism. Perhaps the bigger problem is with the tax code, which favors rich cheaters like Donald Trump (and many others) who pay next to nothing in income taxes while the rest of us struggle to make ends meet and pay our fair share. We don't know yet whether Trump actually committed tax fraud on his personal tax returns. But there can be no doubt that much of what he did that was legal was deceitful and unjust."