⚯ Michel de Cryptadamus ⚯ · @cryptadamist

394 followers · 298 posts · Server universeodon.com🧐

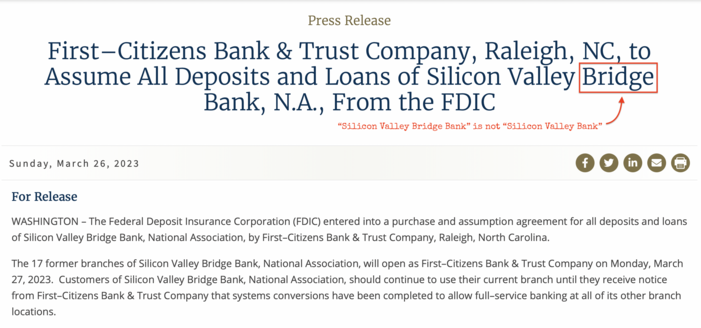

#FDIC's press release makes it sound like #FirstCitizensBank bought all of #SiliconValleyBank.

But... it didn't.

$90 billion in #SVB's toxic loans were left behind, In particular all of the #venturedebt / #fundbanking garbage that will never be repaid bc it relies on new VSs¹ investing an even bigger pile of money into a bullshit tech startup than the last VSs did.

Cost to taxpayers¹ currently estimated at $20bn but it will rise.

more on #SVB: http://cryptadamus.substack.com/p/how-everyone-got-the-story-of-silicon

¹ "Venture Socialists"

² do not whine at me about how the money will come from FDIC not taxpayers because how tf do you think the money got into the FDIC?

#fdic #firstcitizensbank #siliconvalleybank #svb #venturedebt #fundbanking

FinchHaven · @FinchHaven

120 followers · 6803 posts · Server mastodon.sdf.orgEdit:

"...in #California, the [#SVB] bank was behind more than 60 per cent of all [venture debt] deals this year ... Founders and investors fear that the demise of the tech sector’s favourite bank will ripple through to lower valuations and hasten a complete collapse of the [#VentureDebt] house of cards..."

IT News · @itnewsbot

3030 followers · 253852 posts · Server schleuss.onlineStartup leaders sound off on the future of venture debt in fallout from Silicon Valley Bank collapse - Silicon Valley Bank’s motto, “Make Next Happen Now,” in neon inside its Portland,... - https://www.geekwire.com/2023/startup-leaders-sound-off-on-the-future-of-venture-debt-in-fallout-from-silicon-valley-bank-collapse/ #siliconvalleybank #venturedebt #startups

#startups #venturedebt #siliconvalleybank

IT News · @itnewsbot

3002 followers · 252800 posts · Server schleuss.onlineSilicon Valley Bank says credit facilities will be honored amid concern over future of venture debt - Silicon Valley Bank was a leading provider of venture debt, used by startups to h... - https://www.geekwire.com/2023/silicon-valley-bank-says-credit-facilities-will-be-honored-amid-concern-over-future-of-venture-debt/ #siliconvalleybank #venturedebt #startups

#startups #venturedebt #siliconvalleybank

IT News · @itnewsbot

2816 followers · 247577 posts · Server schleuss.onlineExit comeback: After big slowdown in IPO and M&A activity, analysts optimistic for a rebound - SVB Private’s Chief Investment Officer Shannon Saccocia at the Aerlume Seattle re... - https://www.geekwire.com/2023/exit-comeback-after-big-slowdown-in-ipo-and-ma-activity-analysts-optimistic-for-a-rebound/ #siliconvalleybank #venturedebt #pitchbook #startups #ipo #m&a #ey

#ey #m #ipo #startups #pitchbook #venturedebt #siliconvalleybank

IT News · @itnewsbot

2776 followers · 246657 posts · Server schleuss.onlineAs venture capital markets cool, startups consider debt and loans as alternative financing options - (PitchBook chart)

Minh Le has been busy.

As a market manager for Silicon V... - https://www.geekwire.com/2023/as-venture-capital-markets-cool-startups-consider-debt-and-loans-as-alternative-financing-options/ #alternativefinancing #siliconvalleybank #lightercapital #revolverloans #venturedebt #startups #bttn

#bttn #startups #venturedebt #revolverloans #lightercapital #siliconvalleybank #alternativefinancing

European Investment Bank · @EIB

80 followers · 1391 posts · Server respublicae.euUnder our #venturedebt programme, we are providing €15m financing to @BlickfeldLiDAR 🇩🇪to further develop its innovative smart sensor solutions & support new areas of application, like autonomous driving & smart mobility. The funding is backed by #EFSI🇪🇺🔗https://bit.ly/3uIyHzh